At Redford & Co we help you get the best out of your situation

We are a firm of Chartered Accountants and Chartered Tax Advisors based in central London and are committed to providing a first class service tailored to the individual needs of each client. Read more about us >

Specialism

We are small enough to be flexible and to offer a high level of personal service to our clients face-to-face

Find us

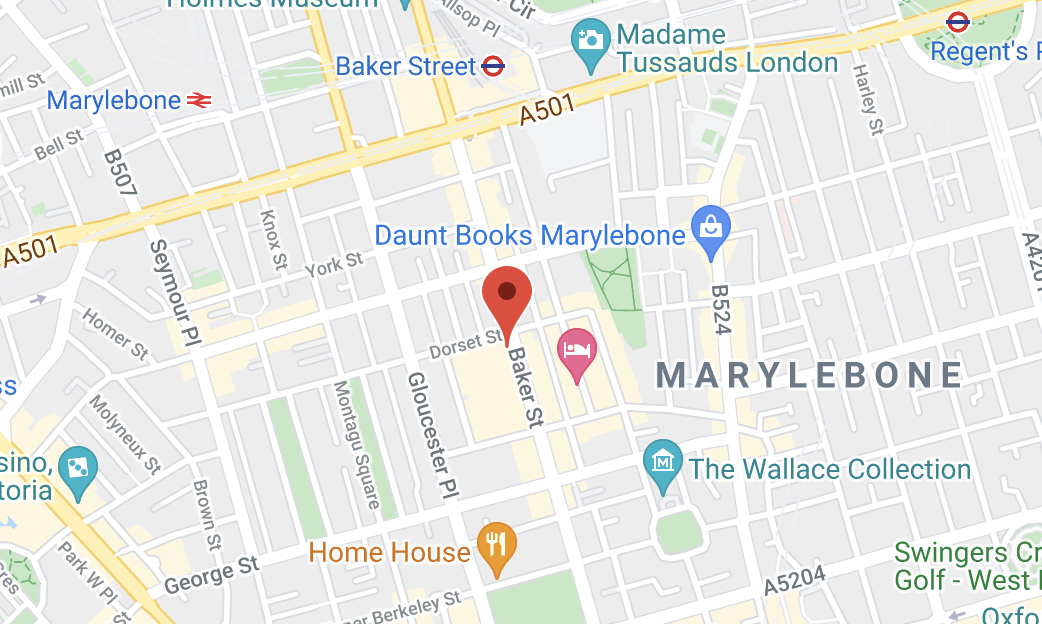

Our office is located on Baker street in

the heart of London. Drop us a line to

arrange an appointment.

Download Tax Card

Our office is located on Baker street in the heart of London. Drop us a line to arrange an appointment.

Testimonials

“Redford & Co’s knowledge and service is outstanding and their advice reliable.”

Joy Lewis

“Redford & Co has considerable experience on advising SMEs and have helped grow my business.”

Robert Taylor Team Fusion Limited

Join our newsletter

Keep up to date with the latest news from us.